22+ paycheck calculator wichita ks

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. 2022 Salary Ranges Spreadsheet.

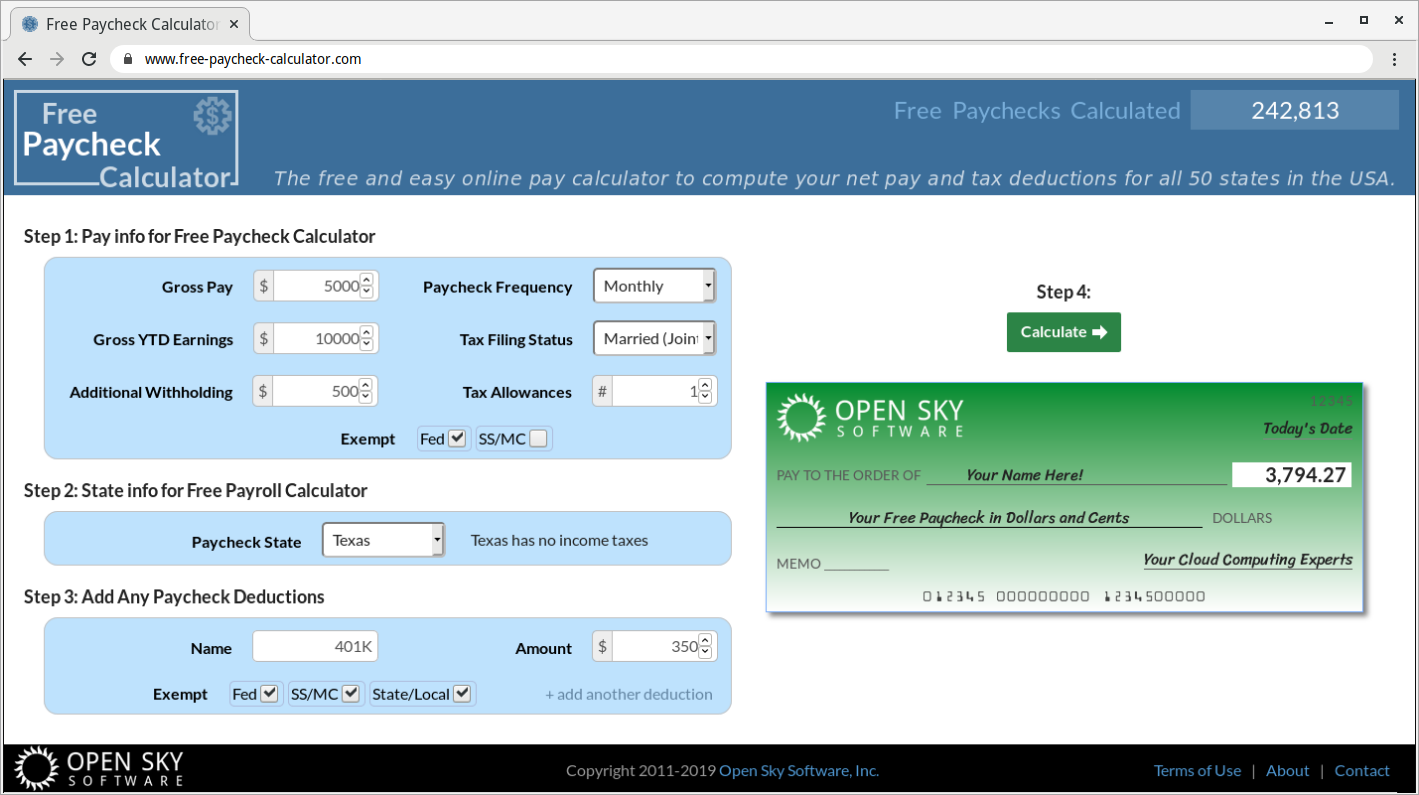

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Calculating paychecks and need some help.

. No state-level payroll tax. 785-532-6277 785-532-6095 fax email. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The average annual pay for a Calculator Job in Wichita KS is 84408 a year. This free easy to use payroll calculator will calculate your take home pay. The tax pays for federal unemployment benefits.

Enter your info to see your take home pay. This Kansas hourly paycheck. 51-693 Exempt Salary Ordinance 2022 51-694 Exempt Salary Classification Ordinance 2022 51-695 Non-Exempt Salary Ordinance 2022 51.

The median household income is 56422 2017. Kansas Hourly Paycheck and Payroll Calculator. Census Bureau Number of cities with local income taxes.

Need help calculating paychecks. Use ADPs Kansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. For a detailed calculation of your pay as a GS employee in Kansas see our General Schedule Pay Calculator.

The income tax rate ranges from 31 to 57. Calculate your Kansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kansas paycheck. Powerhouse Church is a non-profit organization located in Wichita Kansas that received a Coronavirus-related PPP loan from the SBA of 2000000 in February 2021.

Supports hourly salary income and multiple pay frequencies. Has standard deductions and. 0 some cities and.

KANSAS CITY-OVERLAND PARK-KANSAS CITY MO-KS Print Locality Adjustment. Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

How much do Calculator jobs pay a year. Step 6 Minus everything. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kansas.

The rate is 6 of the first 7000 of taxable income an employee earns annually. Kansas Paycheck Quick Facts. Note a huge caveat that you can claim a tax.

Just enter the wages tax withholdings and other information required. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. Human Capital Services Kansas State University 103 Edwards Hall 1810 Kerr Drive Manhattan KS 66506-4801.

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

.jpg?width=350&mode=pad&bgcolor=333333&quality=80)

Midtown Place Apartments 900 N Waco Wichita Ks Rentcafe

Hourly Paycheck Calculator Nevada State Bank

Kansas Salary Paycheck Calculator Paycheckcity

Kansas Salary Calculator 2022 Icalculator

Kansas Paycheck Calculator 2022 2023

Kansas Paycheck Calculator Smartasset

The Aces On Bridge 2015 Bobby Wolff Pdf Contract Bridge Playing Cards

Kansas Paycheck Calculator Tax Year 2022

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

State Farm Mutual Fund Trust

Gartmore Mutual Funds

Gps Lobal Ositioning Ystem Office Of Space

About Free Paycheck Calculator

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Total Scrabble Cross Tables